The 2023 federal budget, which was announced on Tuesday, includes several initiatives related to defined benefit pension plans and the broader institutional investment sector. The government said it would entrust the administration of a new federal investment fund to the Public Sector Pension Investment Board. “By partnering with PSP Investments, the Canada Growth Fund will […]

Over the last year, the number of large Canadian pension funds with commitments to achieving net-zero emissions by 2050 rose from two funds to nine, representing $1.8 trillion — or 81 per cent — of total pension fund assets evaluated, according to a new report by Corporate Knights. The report also found four of the […]

The Public Sector Pension Investment Board is updating its proxy voting guidelines to communicate its views on sound corporate governance practices and climate change. According to the guidelines, boards of directors at the companies in which PSP Investments invests, are expected to ensure climate risks and opportunities are integrated into their strategy and operations. They […]

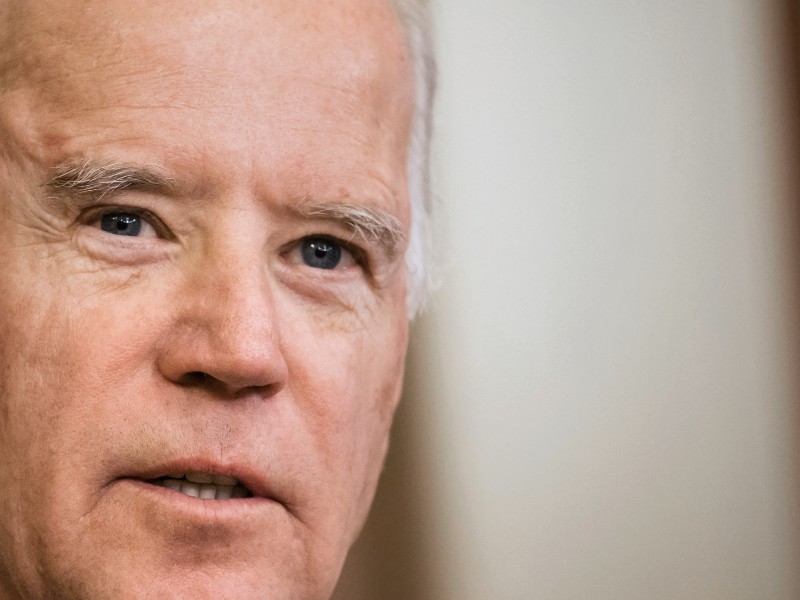

A resolution to reverse a rule allowing U.S. pension investors to consider environmental, social and governance criteria has been blocked by President Joe Biden. “It would put at risk the retirement savings of people across the country,” the president said after issuing his first-ever veto. Through the office’s veto power, a president may block any […]

The Pension Investment Association of Canada is praising the Canadian Association of Pension Supervisory Authorities for addressing the regulatory inconsistencies facing Canada’s defined contribution pension plan sponsors in its draft strategic plan for 2023-2026. “We commend CAPSA for its achievements in engaging with stakeholders to consider evolving regulatory risks and [capital accumulation plan] guideline development,” […]

The Healthcare of Ontario Pension Plan is reporting an annual return of negative 8.6 per cent for 2022, citing declines in equities and fixed income markets. The HOOPP finished the year with net assets of $103.7 billion and, despite the economic challenges, maintained a funded status of 117 per cent. Its fixed income portfolio generated […]

Despite many institutional investors pressing pause on their real estate activities in the early days of the coronavirus pandemic, those that keep calm and carry on with a focus on diversification and innovation are poised to emerge as winners. “Real estate values, like other investment vehicles, can vary at different times based on shifting demand […]

The Ontario Teachers’ Pension Plan is reporting a total fund net return of four per cent for 2022, driven by strong returns from private equity and inflation-sensitive asset classes. The pension fund exceeded its benchmark of 2.3 per cent, according to a press release announcing its annual results. Its inflation-sensitive asset portfolio — including commodities […]

The Healthcare of Ontario Pension Plan is enhancing its climate change strategy to achieve net-zero emissions in its portfolio by 2050. By 2025, the HOOPP expects 80 per cent of its assets to provide reported emissions. It will also initiate a scope 3 portfolio emissions measurement and exclude new direct investments in private thermal coal […]

Investment teams in the top quartile of gender diversity outperform the bottom quartile by 45 basis points yearly in terms of net excess returns, according to a new report by WTW. The report, which analyzed data from more than 1,500 investment strategies and more than 400 asset management firms, found while 80 per cent of […]