As defined contribution plans mature, Canada is seeing the first wave of retirees that only have DC plans and plan sponsors are facing the challenges of this decumulation phase. Speaking during a session at Benefits Canada’s 2025 DC Plan Summit, Yashar Zarrabian, regional vice-president for Quebec at Sun Life Financial Inc., outlined three pillars to […]

The Nova Scotia government is updating the provincial Pension Benefits Act to allow the unlocking of pension benefits. Effective April 1, 2025, plan members aged 55 and older will have a one-time ability to unlock up to 50 per cent of their locked-in funds when transferring to a life income fund. Read: Quebec’s amendment to […]

Nearly two-thirds (63 per cent) of Americans say they worry more about running out of money than death, up from 57 per cent in 2022, according to a new survey by the Allianz Life Insurance Co. of North America. The survey, which polled more than 1,000 employees with $150,000 investable assets, found generation X was […]

During a panel discussion at Benefits Canada’s 2024 Defined Contribution Plan Summit in February, three defined contribution plan sponsors shared their respective decumulation journeys and their thoughts on where the DC plan sector is in terms of effectively supporting this particular phase of plan members’ lives. At ATCO Ltd., roughly 5,500 employees are enrolled across […]

An article on the Canada Revenue Agency’s guidance for how employers must determine the province of employment for remote workers was the most-read story on BenefitsCanada.com. Here are the top five human resources, benefits, pension and investment stories of the week: 1. CRA clarifying how employers must determine province of employment for remote workers 2. Quebec’s amendment […]

The Quebec government’s removal of the maximum annual amount that can be paid to people aged 55 and older with a variable benefit account tied to a defined contribution pension plan or with a life income fund is part of a broader push to provide retirees with more flexibility to draw on their locked-in retirement savings […]

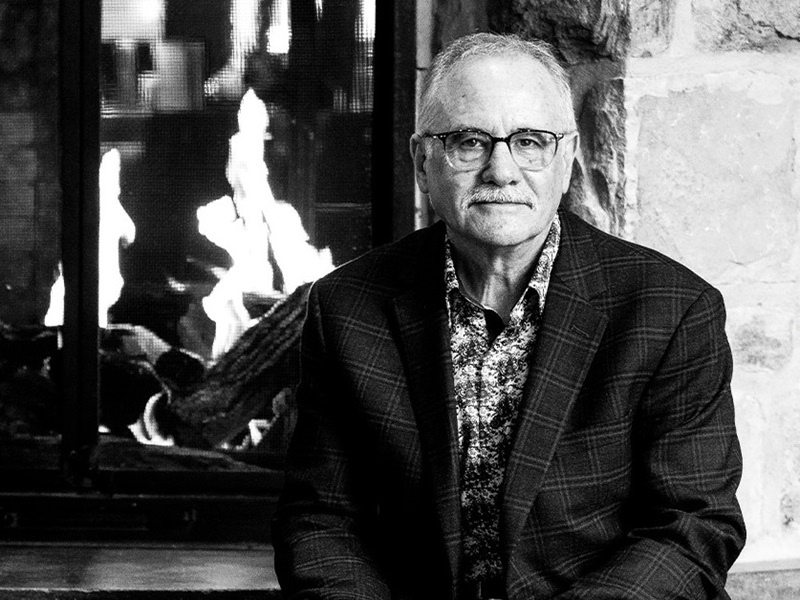

While Blair Richards understands why the industry is moving away from defined benefit pension plans, he worries about what may be lost in the process. When Richards — the chief investment officer at the Halifax Port ILA/HEA pension plan — joined the institutional investor 40 years ago, DB plans were an attractive hiring and retention […]

While the term decumulation may sound very technical and often leads to confusion among pension plan members, it’s actually quite simple — effectively, it’s the opposite of accumulation. These two terms make up the typical retirement savings journey — the accumulation phase is the working years when capital accumulation plan members put away their nest […]

While McGill University has factored decumulation into its pension plan for decades, the plan sponsor is continually fine tuning these strategies for members, said John D’Agata, the university’s director of pension and benefits, during a session at Benefits Canada‘s 2023 DC Plan Summit. McGill’s pension plan has more than $1.5 billion in assets and more than 9,500 […]

Mitigating longevity risk is key to solving the decumulation challenge, said Pat Leo, Purpose Investments Inc.’s vice-president of longevity retirement solutions, during a session at Benefits Canada‘s 2023 DC Plan Summit. Referring to a recent survey, he noted defined contribution pension plan members were most concerned about market and sequence risks, while underestimating the impact of longevity risk. […]