The British Columbia Investment Management Corp. is leveraging its size and influence to drive environmental, social and governance improvements across its portfolio, according to the investment organization’s 2022 ESG annual report. “We believe, as do our clients, that ESG matters, makes a difference and translates to meaningful distinctions in a company’s ability to generate long-term […]

The Association of Canadian Pension Management is urging the Financial Services Regulatory Authority of Ontario to apply a best practices approach for the pension sector in its information technology risk management guidance. In an open letter to the FSRA, the ACPM said a real-time reporting framework for material IT risk incidents could result in a […]

A consortium of five New York City defined benefit pension plans has led a successful campaign to launch an external review of labour practices at Starbucks Corp. NYC Retirement Systems, which includes the NYC Board of Education Retirement System, the NYC Fire Pension Fund, the NYC Fire Pension, the NYC Police Pension Fund and the […]

A watchdog organization is criticizing a government fund dedicated to attracting investments in green technologies. “The government seems to be saying this is concessional finance,” says Adam Scott, executive director of Shift Action for Pension Wealth and Planet Health. “The goal [of the Canada Growth Fund] is to put the first money into higher risk investments […]

Three-quarters (76 per cent) of U.S. defined contribution pension plan sponsors say their plan offers automatic enrolment, according to a new survey by investment consulting firm Callan. The survey, which polled roughly 100 DC plan sponsors, found the vast majority used auto-enrolment for new hires, while far fewer offered this feature for current employees. Half […]

In its 2023 budget on Tuesday, the federal government proposed roughly $13 billion over the next five years and $4.4 billion ongoing to fully implement the national dental-care program. The plan — to be administered by Health Canada, with support from a third-party benefits administrator — will provide dental coverage for uninsured Canadians with annual […]

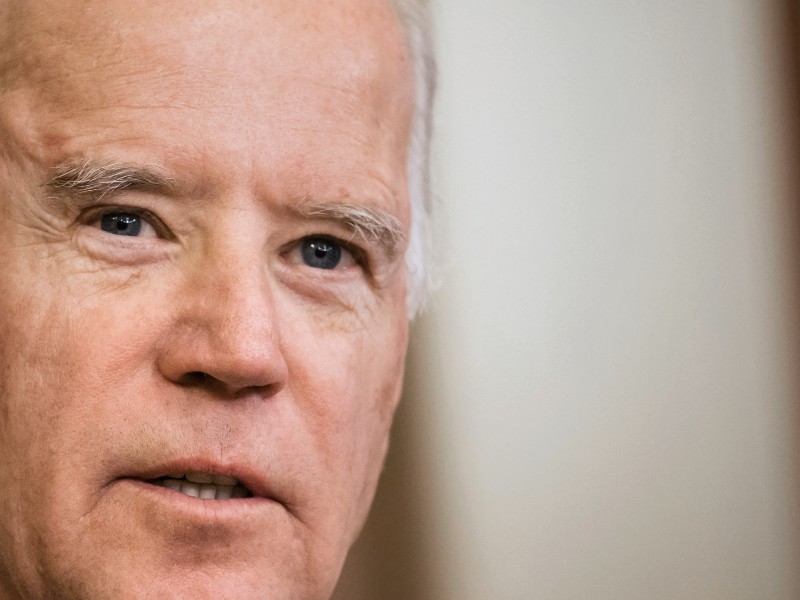

A resolution to reverse a rule allowing U.S. pension investors to consider environmental, social and governance criteria has been blocked by President Joe Biden. “It would put at risk the retirement savings of people across the country,” the president said after issuing his first-ever veto. Through the office’s veto power, a president may block any […]

A British Columbia court has dismissed an appeal of a Supreme Court of B.C. decision that upheld the B.C. Credit Union Employers’ Pension Plan’s choice to increase its normal retirement date to age 65 from age 62. In its decision, the court found the appeal — brought by a group of plan members — alleged […]

The answer is complicated because environmental, social and governance investing is a relatively new risk, not all ESG factors are material for every industry and the return profile ultimately depends on whether a policy successfully incorporates material factors into investment decisions. Chris Reynolds, manager of pension policy at Canada Post Corp. ESG investing, often referred […]

A recent court decision in Ontario illustrates the potential danger for employers that attempt to rely on pension plan terms to refute claims for pension-related losses in the context of wrongful dismissal actions. The case, Williams v. Air Canada, involved a claim by a long-time employee whose employment was terminated in 2020 when the airline […]