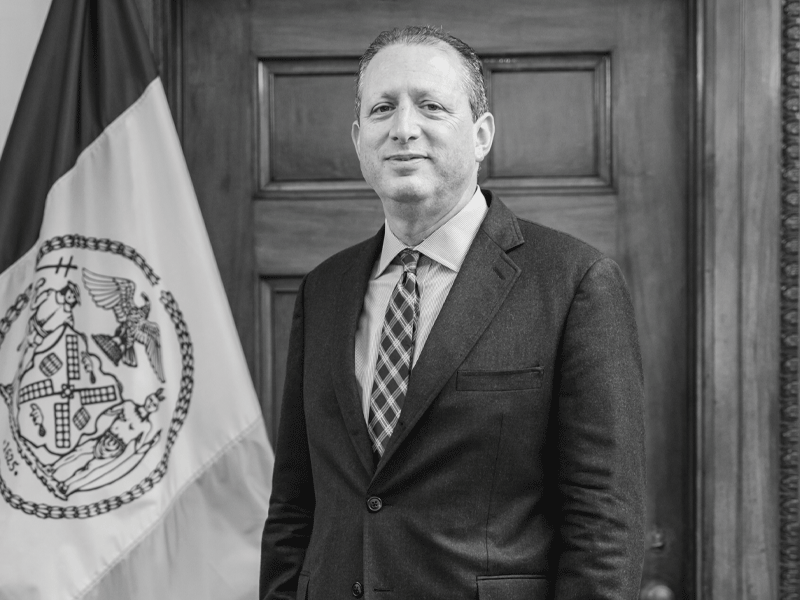

Brad Lander is advocating for public pension funds to enforce their responsible investment mandates even if that pits them against their partners. As New York City comptroller and chief financial officer, he’s the investment advisor and custodian for the city’s five public pension funds. In the role, he oversees the investment guidelines and allocations strategy […]

An independent review of the Ontario Municipal Employees’ Retirement System will examine the unique governance structure of the investment organization. The current structure of the investment organization designates two separate entities with different duties and responsibilities, notes Jordan Fremont, a partner in the pensions and benefits group at Stikeman Elliott LLP. The OMERS Sponsors Corporation […]

The average funded position of defined benefit pension plans in Ontario was 121 per cent in the third quarter of 2024, down just two per cent from the previous quarter, according to a new report by the Financial Services Regulatory Authority of Ontario. It attributed this decrease to a drop in discount rates from the previous […]

An amendment to the federal Pension Benefit Standards Regulations that would establish solvency reserve accounts for federally regulated defined benefit pension plans requires additional clarity and flexibility for plan sponsors, said the Association of Canadian Pension Management. In an open letter to the Department of Finance, the organization said that the establishment of a solvency […]

The British Columbia Financial Services Authority is appointing Tolga Yalkin as chief executive officer and chief statutory officer, effective Jan. 13, 2025. Yalkin succeeds Blair Morrison and will join the BCFSA from his current role leading the regulatory agenda at the Office of the Superintendent of Financial Institutions. Read more People Watch news. “We are thrilled to welcome Tolga […]

An article on how a national drug pooling program would impact employer-sponsored benefits plans was the most-read story on BenefitsCanada.com this past week. Here are the top five human resources, benefits, pension and investment stories of the last week: 1. How would a national drug pooling program impact employer-sponsored benefits plans? 2. Leadership changes at the AIMCo […]

The Pension Investment Association of Canada, alongside the Canadian Life and Health Insurance Association and the Portfolio Management Association of Canada, is asking the Senate to consider the impact of Bill C-281 on institutional investors and pension plan members. The legislation being reviewed by the Senate aims to restrict investments connected to the creation of a […]

Former prime minister Stephen Harper is the new chairman of the Alberta Investment Management Corp. The move comes almost two weeks after the province’s finance minister fired the Crown agency’s entire board, along with a number of executives, citing ballooning costs and substandard returns. Read: Leadership changes at the AIMCo could impact credibility, independence: expert Premier […]

The swift removal of the chief executive officer, three executives and the 11-person board at the Alberta Investment Management Corp. is a dramatic move that raises red flags about the influence of Alberta’s provincial government, says Anthony Guindon, a partner at Koskie Minsky LLP. “We don’t entirely know at this stage but it makes one […]

For the fourth year in a row, five Canadian pension funds are among the most transparent in the world, according to the global pension transparency benchmark, a collaboration between Top1000funds.com and CEM Benchmarking Inc. The benchmark, launched in 2021, measures the transparency of disclosures of 15 pension systems across measurements such as cost, governance, performance […]