The federal government’s recent decision to transfer a $1.9 billion surplus from the Public Service Pension Plan to its general revenue is within its purview, says Mitch Frazer, a pension lawyer and managing partner at Mintz, Levin, Cohn, Ferris, Glovsky and Popeo. “[This situation is] slightly different because this plan is made by a statute and, […]

Finance Minister Chrystia Freeland says today’s fall economic statement will remove the cap that currently restricts Canadian pension funds from owning more than 30 per cent of the voting shares of a Canadian entity. Freeland says this will make it easier for Canadian pension funds, which have more than $3 trillion in assets, to make […]

The keynote session at Benefits Canada’s 2024 Defined Contribution Investment Forum warned that the failure to plan for the ‘boomer bulge’ is affecting private and public pension policy. The presentation from Paul Kershaw, a policy professor at the University of British Columbia and founder of not-for-profit organization Generation Squeeze, got me thinking: if the influx […]

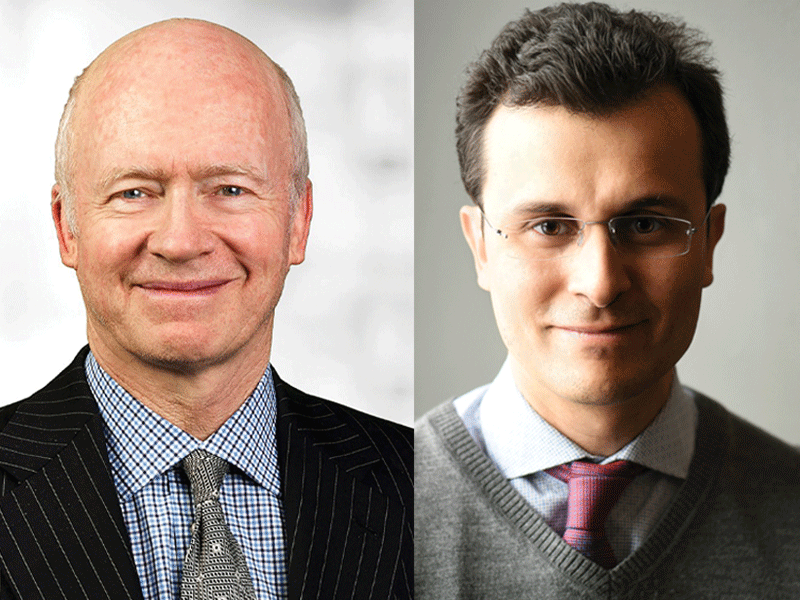

While both experts point to the obligation of the pension promise, one argues that many pension funds are already overweight in Canadian allocations, while the other cites these funds’ risk-return calibrations, highlighting the strategic assets available abroad. Jeremy Forgie, pension lawyer and senior counsel at Blake, Cassels & Graydon LLP Whether our governments should try […]

As gig workers make up a greater share of the Canadian workforce, a lack of retirement savings options may leave this growing demographic facing financial insecurity in their senior years. According to data from Statistics Canada, 871,000 Canadians performed gig work as their primary job in the fourth quarter of 2022. Among those gig workers, […]

An independent review of the Ontario Municipal Employees’ Retirement System will examine the unique governance structure of the investment organization. The current structure of the investment organization designates two separate entities with different duties and responsibilities, notes Jordan Fremont, a partner in the pensions and benefits group at Stikeman Elliott LLP. The OMERS Sponsors Corporation […]

Amendments to the federal Pension Benefits Standards Act must go beyond reporting transparency and clarify how additional disclosure requirements help monitor the health of Canadian pension plans, said the Pension Investment Association of Canada. In an open letter to Finance Canada, the PIAC said if current data collection processes for federally regulated plans aren’t achieving […]

While global pension plan sponsors’ assets grew by 10 per cent to reach US$63.1 trillion in 2023, this value is still five per cent lower than in 2021, according to a new report by the Organisation for Economic Co-operation and Development. It found this growth was largely attributed to gains in equity markets last year […]

An amendment to the federal Pension Benefit Standards Regulations that would establish solvency reserve accounts for federally regulated defined benefit pension plans requires additional clarity and flexibility for plan sponsors, said the Association of Canadian Pension Management. In an open letter to the Department of Finance, the organization said that the establishment of a solvency […]

The British Columbia Financial Services Authority is appointing Tolga Yalkin as chief executive officer and chief statutory officer, effective Jan. 13, 2025. Yalkin succeeds Blair Morrison and will join the BCFSA from his current role leading the regulatory agenda at the Office of the Superintendent of Financial Institutions. Read more People Watch news. “We are thrilled to welcome Tolga […]