What’s in a name? A pension by any other name would smell as sweet — or would it? I started writing this month’s Pension Feature as an exercise to sift through some of the terms used by the pension industry to describe the different types of plans, but also to answer the question: Does the […]

Spain’s left-wing government won the backing of unions to reform the nation’s public pension system on Wednesday, in stark contrast with neighbouring France, where plans to raise the retirement age have led to waves of strikes and mass protests. The leaders of Spain’s two main labour unions, UGT and CC.OO., appeared alongside Minister of Social Security […]

The French government’s plans to reform the national pension system have been met by widespread protest. Elisabeth Borne, France’s prime minister, unveiled plans to raise the minimum age required to claim benefits from the Caisse Nationale d’Assurance Vieillesse from 62 to 64 by 2030. In addition, the government proposed that claimants will be required to […]

While many Alberta employers say they’d be disadvantaged if the province left the Canada Pension Plan, one expert says a provincial pension plan could benefit members by reducing contributions and increasing retirement savings. Last November, Alberta Premier Danielle Smith instructed the province’s finance minister to provide recommendations on the implementation of a provincial pension plan. According […]

The Association of Canadian Pension Management’s top priority in 2023 is convincing Canada’s senate to amend or block the passage of Bill C-228, according to Ric Marrero, the association’s president and chief executive officer. “Our first priority is to keep monitoring Bill C-228, which is now in the senate. Our members think it would cause […]

Since employers play a key role in supporting pension growth, policy-makers should consider their involvement when implementing pension reforms, according to a new report by the Organisation for Economic Co-operation and Development. The report found OECD member countries can optimize employer involvement by reducing financial and administrative barriers that prevent employers from establishing pension plans, […]

After a tough couple of years, Canadians continue to face several challenges against an increasingly turbulent economic landscape. While most coronavirus restrictions were lifted in late spring 2022, the seventh wave of the pandemic arrived in July alongside rising inflation, which is compounding prices from the gas pump to the grocery store. Though the 2022 […]

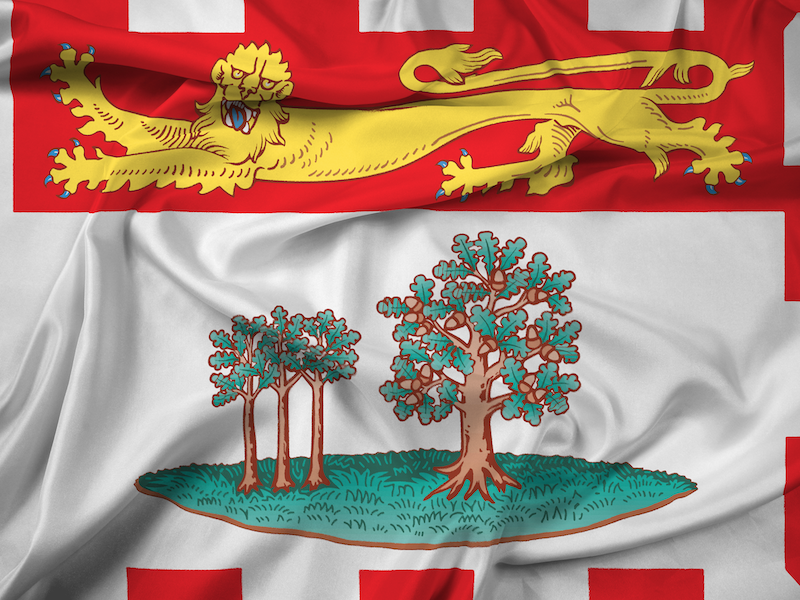

The Association of Canadian Pension Management is calling on Prince Edward Island’s pension regulator to amend the Employment Standards Act to facilitate auto-enrolment and auto-escalation features in workplace pension and savings plans. The current legislation includes language that would prohibit pension plan administrators from introducing automatic features in workplace plans, including capital accumulation plans such […]

The Office of the Superintendent of Financial Institutions and the Financial Services Regulatory Authority of Ontario are putting forward six recommendations for strengthening the Canadian Association of Pension Supervisory Authority’s capital accumulation plan guidelines. In a webinar hosted in November 2021, the regulators shared the outcomes of its technical advisory committee and solicited feedback from the […]

An eight-year legal effort to reverse a law that transformed New Brunswick’s public sector pension plan away from an indexed defined benefits model is being scrapped. Pension Coalition NB, an association that represents 13,000 public sector retirees in the province, will end its legal efforts to oppose a 2013 bill that transformed N.B.’s public sector pensions […]