While some pension fund managers swear by hedge funds, others would never sink in a single cent. After the 2008 financial crisis turned some investors sour, is it time to give hedge funds a second chance? Colin Spinney, treasurer at Dalhousie University: The Dalhousie pension plan once had a stand-alone allocation to hedge funds, or […]

With India attracting the attention of Canadian pension plans, what opportunities and risks exist in the country? Across all asset classes, 2018 saw US$47 billion in foreign investment transactions into India, according to Sanjeev Krishan, deals and private equity expert at PwC India, during the Canadian Investment Review’s podcast “Pension Passport.” And this year could […]

The Canada Pension Plan Investment Board closed out the first quarter of its 2020 fiscal year with a 1.1 per cent net return. The fund added $8.6 billion to its assets, with $4.5 billion in CPP contributions and the other $4.1 billion in net income. “CPPIB’s investment programs performed well in the first quarter, achieving solid net income in […]

The Ontario Teachers’ Pension Plan and Australian superannuation fund AustralianSuper are investing up to US$1 billion each in the National Investment and Infrastructure Fund of India’s master fund. The agreement includes US$250 million from each pension fund, as well as investment rights of up to US$750 million each for ongoing opportunities alongside the master fund. In addition, the […]

The number of Canadian venture capital deals declined in the first half of 2019, according to research from PwC Canada. The total amount raised by Canadian companies was down 13 per cent for the first six months of the year compared to the same time period in 2018, with the number of deals down by […]

The Public Sector Pension Investment Board, alongside private equity firm Lightyear Capital, have completed the sale of Advisor Group Inc. to Reverence Capital Partners. Since the partners acquired Advisor Group in May 2016, client assets under administration increased more than 73 per cent, from $157 billion to $272 billion. At the same time, the group grew from 5,200 […]

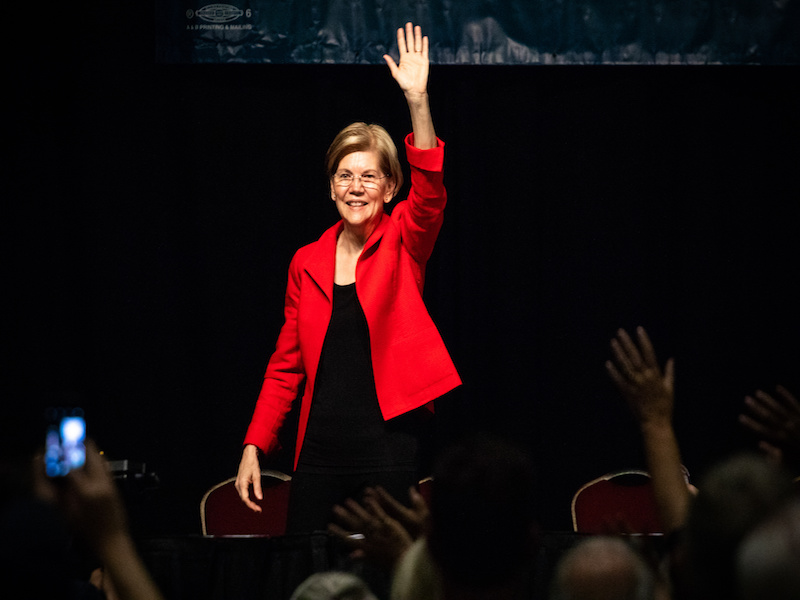

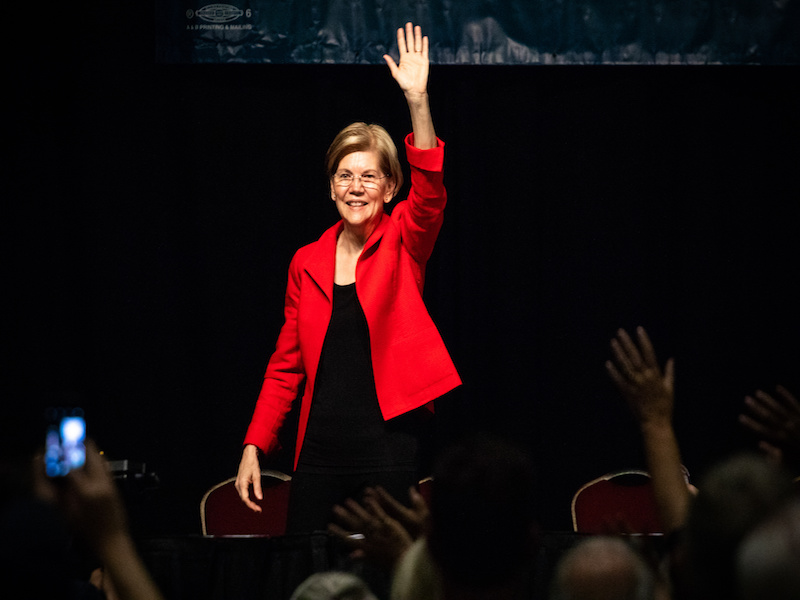

Senator Elizabeth Warren, who is running to become the next presidential candidate for the U.S. Democratic Party, has proposed new legislation attacking the private equity industry and calling for major reforms. The Stop Wall Street Looting Act of 2019 proposes stringent rules around private equity transactions, including making private equity firms share responsible for the debts incurred by […]

Leveraged buyouts have a reputation for creating bankruptcy risk for the company being purchased. “With the recent wave of private equity-backed leveraged buyouts that are ending in bankruptcy, politicians, regulators and the general public are once again becoming more concerned with these highly levered transactions,” said the paper by Brian Ayash and Mahdi Rastad, both […]

The Canada Pension Plan Investment Board, along with investment firm EQT Partners, is acquiring a majority stake in Waystar Inc. from Bain Capital valued at $2.7 billion. Bain Capital will retain a minority interest in Waystar, which provides revenue cycle management software for health-care operations from large hospitals to individual physician offices. The technology, which streamlines […]

The Nova Scotia Public Service Superannuation Plan posted a 5.33 per cent return for the 2018/19 fiscal year, with $335 million in total investment income, according to its annual report. Net of investment management fees, the plan’s rate of return was 5.13 per cent. Measured both ways, the returns slightly underperformed the plan’s benchmark rate of […]