As sustainable investing continues to gain widespread acceptance among institutional investors, full integration is projected to surge in the next five years, according to a new study conducted by Coalition Greenwich and commissioned by AGF Investments. It found nine in 10 institutional investors in North America and Europe expect to be investing sustainably or working […]

North American institutional investors raised $749.7 billion, nearly half (49 per cent) of the $1.53 trillion total private capital raised globally between the second half of 2022 and the end of May 2023, according to a report by Preqin. It found the weakest period for deal activity since the start of the coronavirus pandemic was […]

Investments in office real estate, as a part of total transaction activity, declined by 20 per cent in North America and 50 per cent in Europe and Asia-Pacific in 2022, according to a new report by TD Global Investment Solutions. It found while global office transaction cap rates rose over the past year, private asset […]

More than half (56 per cent) of institutional investors say they plan to increase their allocation to alternative investments allocation over the next 12 months, up slightly from 55 per cent in 2022, according to a new survey by research firm Dynamo Software Inc. The survey, which polled more than 100 global respondents, found among respondents […]

Nearly all (93 per cent) institutional investors believe the Chinese yuan is going to become the reserve currency for multiple countries within the next five years, according to a new study by mining firm Tresor Gold. It found a third (30 per cent) of respondents believe the move will prove highly successful, while only two per cent […]

The funded ratio of the 100 largest U.S. public defined benefit pension plans increased to 76.8 per cent as of July 31, up from 75.8 per cent at the end of June, according to a new report by consulting firm Milliman Inc. It found a second consecutive month of positive market performance drove this result, […]

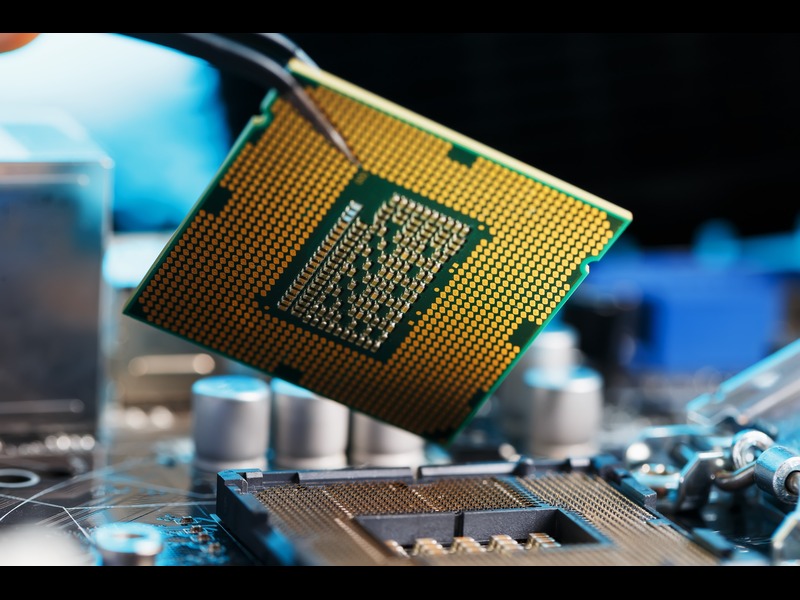

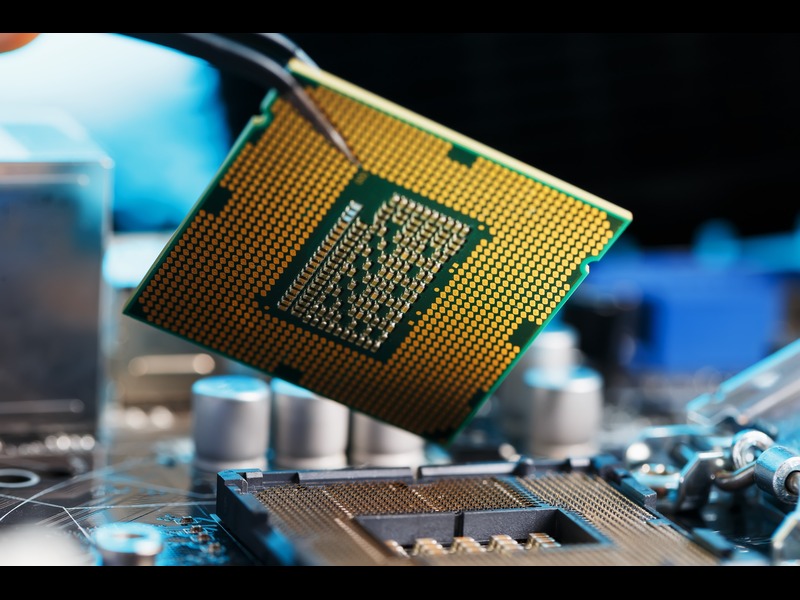

As U.S. President Joe Biden signs an executive order obstructing the departure of domestic capital from venture and private capital into China, it’s raising a red flag for institutional investors interested in significant returns from the advanced technology space. The executive order, which took effect earlier this month, branded the production of semi-conductors, quantum computers […]

Institutional investors in Asia and Europe are at the forefront of adopting environmental, social and governance investment strategies, while North America lags behind, according to a survey by Coalition Greenwich. Globally, the survey found 75 per cent of investors incorporate ESG strategies, with Europe leading at 92 per cent followed by Asia at 76 per […]

Ontario-based defined benefit pension plans returned, on average, 0.7 per cent on their investments in the second quarter of 2023, according to a new report by the Financial Services Regulatory Authority of Ontario. It found the positive return contributed to a small increase in the median projected solvency ratio, which increased to 116 per cent. […]

The Ontario Teachers’ Pension Plan is reporting a total fund net return of 1.9 per cent for the six-month period ended June 30, 2023. The 12-month total fund net return was 4.8 per cent while net assets increased to $249.8 billion, according to a press release, which noted the five- and 10-year annualized total fund […]