Benefits Canada celebrated the Defined Contribution Plan Summit’s 25th anniversary by looking at how the world has changed over the last quarter century, the subsequent impact on the pension sector and what’s next for DC pensions. On Feb. 26-28 in Montreal, the 2025 DC Plan Summit highlighted the lessons of the last several decades, putting […]

As defined contribution plans mature, Canada is seeing the first wave of retirees that only have DC plans and plan sponsors are facing the challenges of this decumulation phase. Speaking during a session at Benefits Canada’s 2025 DC Plan Summit, Yashar Zarrabian, regional vice-president for Quebec at Sun Life Financial Inc., outlined three pillars to […]

An emerging trend in U.S. defined contribution investment strategies is the ‘blend trend,’ which is a target-date solution that allocates to underlying building blocks that are managed both actively and passively. During a session at Benefits Canada’s 2025 DC Plan Summit, Jessica Sclafani, global retirement strategist at T. Rowe Price, shared data from the investment […]

Rather than a single defined contribution plan sponsor tackling the decumulation dilemma alone, decisions need to be reframed as a decumulation ecosystem, said Nicole Lomax, vice-president and portfolio manager in institutional asset allocation at TD Asset Management Inc. During a session at Benefits Canada’s 2025 DC Plan Summit, she outlined the five decumulation priorities based […]

The volatile global conditions of the last four years have culminated in a looming economic downturn, impacting defined contribution pension plan sponsors and members alike. On Oct. 3 at the Omni King Edward Hotel in Toronto, the 2024 DC Investment Forum highlighted the various tools and strategies that can help plan sponsors navigate turbulent economic waters […]

Canadian defined contribution plan members’ knowledge of target-date funds is lacking and it may point to a larger issue: the stakes set for member investment knowledge may be too high, hindering engagement efforts, according to a survey by MFS Investment Management. The survey of around 1,000 Canadian DC plan members, including 700 active members and 300 […]

Pension plan members’ primary concerns about their golden years are whether they’ve saved enough money to live their dream retirement, whether those funds will last and whether they’ll be able to leave a legacy for their family. But numerous surveys of Canadians indicate many don’t feel financially literate enough to address those concerns, according to […]

The rapid rise in the cost of living in 2022 and into 2023 underscored the need for target-date funds to not just protect against standard inflation, but inflation shocks as well. The problem that presents is the more inflation protection that’s added into a portfolio, the lower the returns, said Nick Nefouse, managing director, global […]

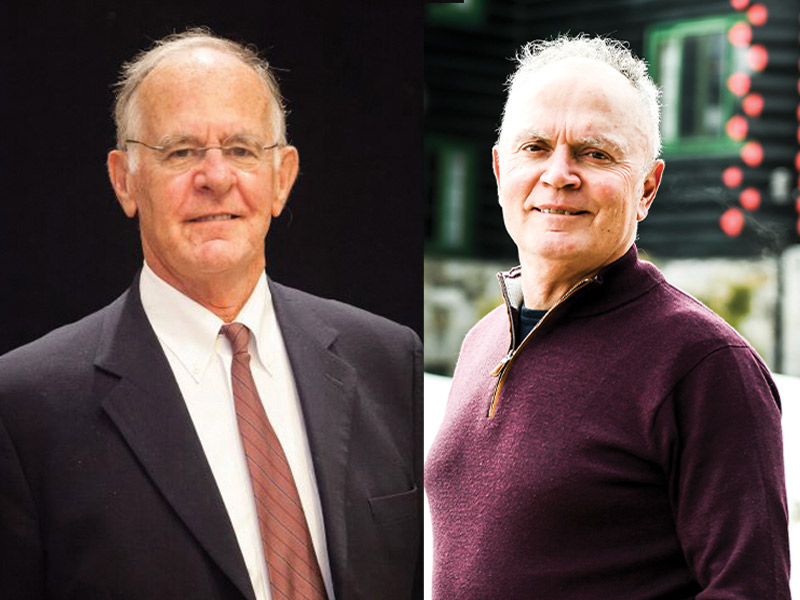

One actuary says social and technological factors are changing the concept of retirement, while another notes the fundamentals remain the same. Michel St-Germain, retired actuary, fellow and past president of the Canadian Institute of Actuaries Yogi Berra once said: “The future ain’t what it used to be.” Millennials will be retiring in 25 years, but not […]

Ford of Canada is is transferring the longevity risk for $923 million in pension plan liabilities through a group annuity buyout. RBC Insurance, Sun Life Assurance Co. of Canada and Desjardins Group will assume responsibility for making pension payments to 2,700 of the plan’s members, who retired on or prior to June 1, 2021. Read: GM Canada […]