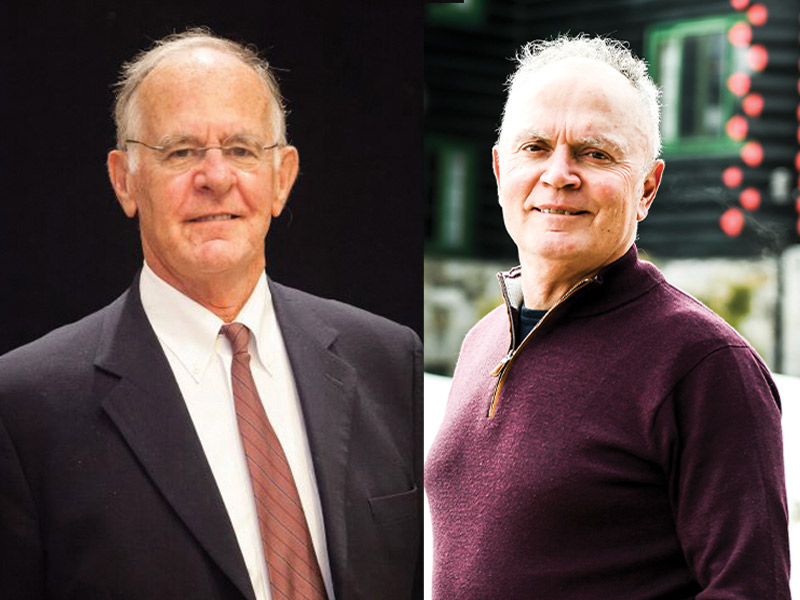

One actuary says social and technological factors are changing the concept of retirement, while another notes the fundamentals remain the same. Michel St-Germain, retired actuary, fellow and past president of the Canadian Institute of Actuaries Yogi Berra once said: “The future ain’t what it used to be.” Millennials will be retiring in 25 years, but not […]

Half (51 per cent) of U.S. pre-retirees and retirees say they’re considering either delaying or coming out of retirement, according to a new survey from F&G Annuities & Life Inc. The survey, which polled more than 2,000 adults aged 50 and older and who have more than US$100,000 in financial products/savings, found among respondents who […]

Nearly two-thirds (64 per cent) of Americans say they wish they’d started saving for retirement when they were younger than age 25, according to a new survey by Voya Financial Inc. The survey, which polled more than 1,000 Americans adults, found more than half said they started saving for retirement when they were between ages 18 […]

Half (51 per cent) of women in the U.S. aged 65 who are entering their peak retirement years have less than $100,000 saved, with the percentage rising (67 per cent) among single women, according to a new survey by Artemis Strategy Group on behalf of non-profit the Alliance for Lifetime Income. The survey, which polled more than 2,500 consumers between […]

A majority (83 per cent) of U.S. workers say they’re concerned the increasing cost of living will make it harder to save for retirement and more than three-quarters (78 per cent) are concerned inflation will stay high, according to a new survey by the Employee Benefit Research Institute and Greenwald Research. The survey, which polled […]

When Phillip Kotanidis took over as chief human resources officer at Toronto’s Michael Garron Hospital in 2018, the financial well-being of staff wasn’t exactly high on his agenda. In such a fast-paced and potentially stressful workplace, money matters naturally took a backseat to the physical and mental health of the hospital’s staff, who are members […]

Nearly two-thirds (63 per cent) of Americans say they worry more about running out of money than death, up from 57 per cent in 2022, according to a new survey by the Allianz Life Insurance Co. of North America. The survey, which polled more than 1,000 employees with $150,000 investable assets, found generation X was […]

Capital accumulation plan members saw a slight uptick in their plan outcome in the first quarter of 2024, as annuity rates rebounded to levels comparable to those from the third quarter of 2023 and gross income replacement ratios remained at multi-year highs, according to a new report by Eckler Ltd. The consultancy’s latest CAP income […]

An article on the federal government’s financial sanctions against the Canada Life Assurance Co. following delayed benefits access for public employees was the most-read article on BenefitsCanada.com. Here are the top five human resources, benefits, pension and investment stories of the past week: 1. Canada Life facing gov’t financial sanctions following delayed benefits access for public […]

While a majority of U.S. employees say they’re very confident (39 per cent) or confident (29 per cent) they’re doing a good job preparing for retirement, nearly two-thirds (62 per cent) either strongly or somewhat agree that preparing for retirement makes them feel stressed, according to a new survey by the Employee Benefit Research Institute. […]