The first issue of Benefits Canada hit the desks of the country’s human resources, benefits, pension and investment professionals in 1977, four years before I was born. That same year, Canada’s inflation rate was eight per cent, very close to July 2022’s annualized inflation rate of 7.6 per cent. A lot has changed in 45 […]

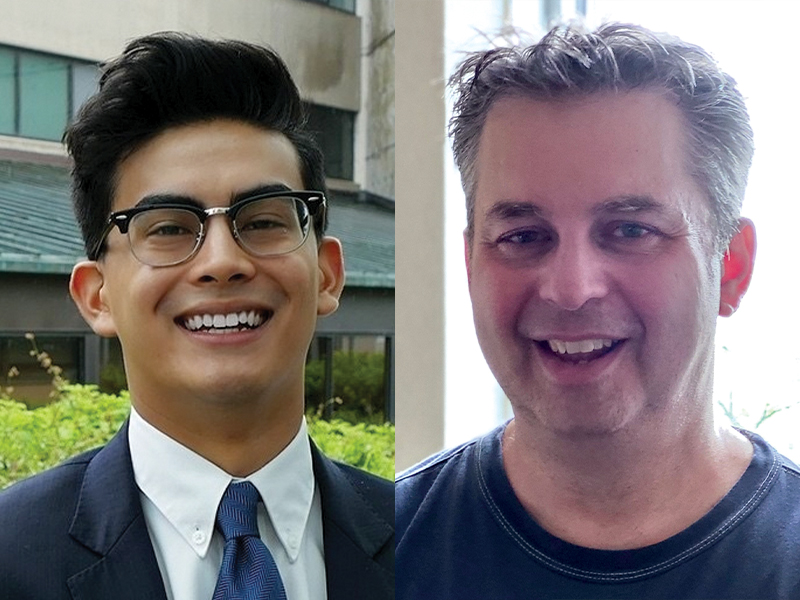

As Canadians face continued economic uncertainty, a recent university graduate and a long-time teacher share their views on balancing different financial priorities. Sul Mahmood, age 24, a product specialist at OpenPhone Technologies Inc. Canadians should be saving for a combination of retirement and other financial priorities. If there’s anything I know (and from all the […]

Married women are more likely to say they’re confident they’ll have enough money to live comfortably throughout their retirement years than both divorced and single, never-married women, according to a new survey by the U.S.-based Employee Benefit Research Institute. It found married women (80 per cent) are more likely to have a workplace retirement savings […]

The vast majority (90 per cent) of low to moderate income workers say they’d open a long-term savings account if they were offered incentives, according to a new survey by the Defined Contribution Institutional Investment Association and non-profit organization Commonwealth. The survey, which polled nearly 1,000 employees living on low to moderate incomes, found most respondents […]

The union representing nearly 800 employees at Calgary and Vancouver airports has ratified a first contract that includes retirement and benefits gains. The contract cements the continuation of the airline’s employee savings plan, which permits contributions to either a cash savings plan, a group registered retirement savings plan or a group tax-free savings account. Employee contributions […]

While more than half (58 per cent) of employees within 10 years of retirement are contributing to retirement savings, only about a third (30 per cent) have established a thorough financial plan, according to a new survey by Age Wave and Edward Jones Canada. The survey, which polled more than 1,000 Canadians aged 45 or […]

Pension and retirement plan members in Saskatchewan can now designate beneficiaries through electronic means. The provincial government recently passed a series of amendments regarding the electronic handling of legal matters. Bill 56 specifically allows individuals to name beneficiaries electronically for certain types of plans including an employee pension, retirement, welfare or profit-sharing fund or plan, […]

Employers are increasingly facing a tight labour market and need to compete for top talent with a stronger benefits offering. Using technology to compare offerings across insurance companies and other providers can ensure employers have a cost-competitive plan that speaks to employees’ needs, said Matt Lister, co-founder and chief executive officer at CloudAdvisors, during Benefits […]

With a record number of Canadians nearing retirement, employers can support workers through retirement planning initiatives and education, says one expert. According to a report released last week by Statistics Canada, more than a fifth (22 per cent) of Canadian employees are aged 55 to 64. It also found more Canadians are aged 55 to 64 than young adults […]

Almost a third (29 per cent) of Canadians believe their employer-sponsored pension plan will be their primary source of retirement income, while 15 per cent said they’re relying on government pension plans, according to LifeWorks Inc.’s latest financial well-being index. The survey, which polled 3,000 Canadian employees, found the overall financial well-being score decreased slightly […]