A fifth (20 per cent) of U.S. workers aren’t currently saving for retirement, according to a new survey by Flexjobs. The survey, which polled more than 2,000 U.S workers, found nearly two-thirds (61 per cent) of men said they’ve been saving for retirement for a while, compared to 52 per cent of women. Across generations, […]

The average amount that U.S. adults have saved for retirement dropped slightly from US$89,300 in 2023 to $88,400 in 2024 and more than $10,000 from its five-year peak of $98,800 in 2021, according to a new survey by Northwestern Mutual Life Insurance Co. The survey, which polled more than 4,500 U.S. adults aged 18 or older, found a third […]

An article on why Canadian workers say job flexibility is key to satisfaction was the most-read story on BenefitsCanada.com this past week. Here are the top five human resources, benefits, pension and investment stories of the last week: 1. 70% of Canadian workers say flexibility key to job satisfaction: survey 2. Only a quarter of Canadian employees […]

Capital accumulation plan members continued to see an uptick in their plan outcome for the second quarter of 2024, as gross income replacement ratios remained at multi-year highs, according to a new report by Eckler Ltd. The consultancy’s latest CAP income tracker found a typical male member retiring at the end of June 2024 achieved […]

Alberta’s finance and treasury board warned against releasing the official results from a government survey evaluating the interest in a new potential pension plan, according to a report by the Edmonton Journal. The survey, launched on Sept. 21, 2023, coincided with the release of a report by LifeWorks Inc. (now part of Telus Health) that argued […]

An article on the nuances of Quebec’s pension laws was the most-read story on BenefitsCanada.com this past week. Here are the top five human resources, benefits, pension and investment stories of the last week: 1. What should employers know about Quebec’s pension legislation? 2. Ontario’s new regulations for publicly advertised jobs providing transparency for job-seekers: expert 3. Canadian […]

Working grandparents who are providing financial support to children and/or grandchildren are risking their own plans for retirement, says Craig Bannon, director of financial planning centre of expertise at the Royal Bank of Canada. “[They might need to] delay their retirement to extend their earning years or continue to work on a part-time basis in […]

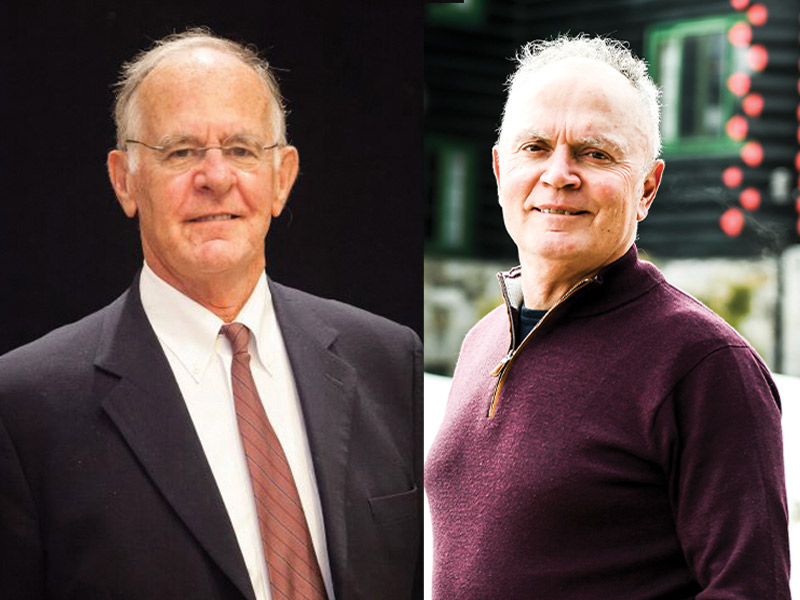

One actuary says social and technological factors are changing the concept of retirement, while another notes the fundamentals remain the same. Michel St-Germain, retired actuary, fellow and past president of the Canadian Institute of Actuaries Yogi Berra once said: “The future ain’t what it used to be.” Millennials will be retiring in 25 years, but not […]

Half (51 per cent) of U.S. pre-retirees and retirees say they’re considering either delaying or coming out of retirement, according to a new survey from F&G Annuities & Life Inc. The survey, which polled more than 2,000 adults aged 50 and older and who have more than US$100,000 in financial products/savings, found among respondents who […]

An article detailing how Canada’s exemplary pension regulatory system is helping to safeguard plans from mismanagement was the most-read story on BenefitsCanada.com this week. Here are the top five human resources, benefits, pension and investment stories of the past week: 1. Culture of compliance prevents mismanagement, conflict at Canadian pension funds: expert 2. OPB making key appointments […]