The Ontario Pension Board scored at or above the median for the Principles for Responsible Investment Reporting Framework assessment tool, according to its latest sustainability report. The OPB earned its highest score (87 per cent) for its policy governance and strategy, followed by passive listed equity and active listed equity, both at 81 per cent. […]

The Caisse de dépôt et placement du Québec is reporting nearly 80 per cent, or $330 billion, of its total portfolio is invested in assets with a low-carbon footprint. In its latest sustainable investing report, the Caisse said it holds $6.2 billion worth of transition assets looking to decarbonize their operations. The investment organization exceeded […]

The urgency surrounding the climate change crisis is pushing institutional investors to focus on stricter measurements in the fight against confusing data that delays meaningful action. But voluntary measurements won’t be enough, as investors have already raised red flags against unreliable climate impact measurements getting in the way of their emissions reduction goals. The start […]

Institutional investors are facing significant barriers to including Scope 3 emissions as part of their disclosure strategy for environmental assets, according to a new report by the United Nations’ Net-Zero Asset Owner Alliance. It found asset owners need to accommodate Scope 3 emission disclosures as part of their overall strategy to create a meaningful climate-centric […]

User personalization and an ease-of-use approach are key in the adoption of artificial intelligence technology tools by pension plan sponsors, according to a new report by the CFA Institute Research & Policy Centre. It found the application of AI has the potential to revolutionize plan sponsors’ administrative duties but will require a collaborative approach that […]

The Canadian Sustainability Standards Board has released its sustainability disclosure standards that align with global sustainability disclosure guidelines, while addressing specific Canadian circumstances. The framework includes general requirements for disclosure of sustainability-related financial information (CSDS 1) and climate-related disclosures (CSDS 2). Ten of Canada’s largest pension plan sponsors and investment managers, representing more than $2.25 […]

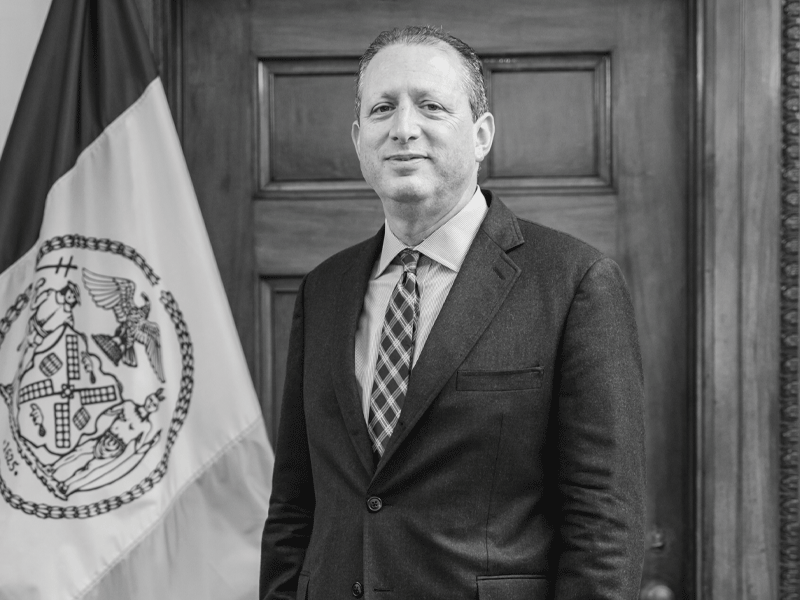

Brad Lander is advocating for public pension funds to enforce their responsible investment mandates even if that pits them against their partners. As New York City comptroller and chief financial officer, he’s the investment advisor and custodian for the city’s five public pension funds. In the role, he oversees the investment guidelines and allocations strategy […]

The Canadian edition of an international set of sustainability investment disclosure standards will be officially released in December, according to the Canadian Sustainability Standards Board. The organization was tasked with creating a set of sustainability investment standards in Canada based on those created by the International Sustainability Standards Board. The two new disclosure metrics — CSDS […]

The volatile global conditions of the last four years have culminated in a looming economic downturn, impacting defined contribution pension plan sponsors and members alike. On Oct. 3 at the Omni King Edward Hotel in Toronto, the 2024 DC Investment Forum highlighted the various tools and strategies that can help plan sponsors navigate turbulent economic waters […]

The Canada Pension Plan Investment Board is investing £500 million in a new U.K.-based single-family rental housing joint venture. The initial allocation will give the investment organization a 90 per cent stake in the venture, while its partner, global real estate investment company Kennedy Wilson Holdings Inc., will hold a 10 per cent ownership stake […]